Sensoneo is a deposit return system integrator that uses the most advanced technologies to maximize the efficiency of the deposit return scheme. Implementing DRS has almost immediate effect on reducing litter and increasing recycling. However it can also be quite a challenge in terms of adapting the current infrastructure and building new plants, centers, and other facilities. In order for DRS to be a success, planning is key.

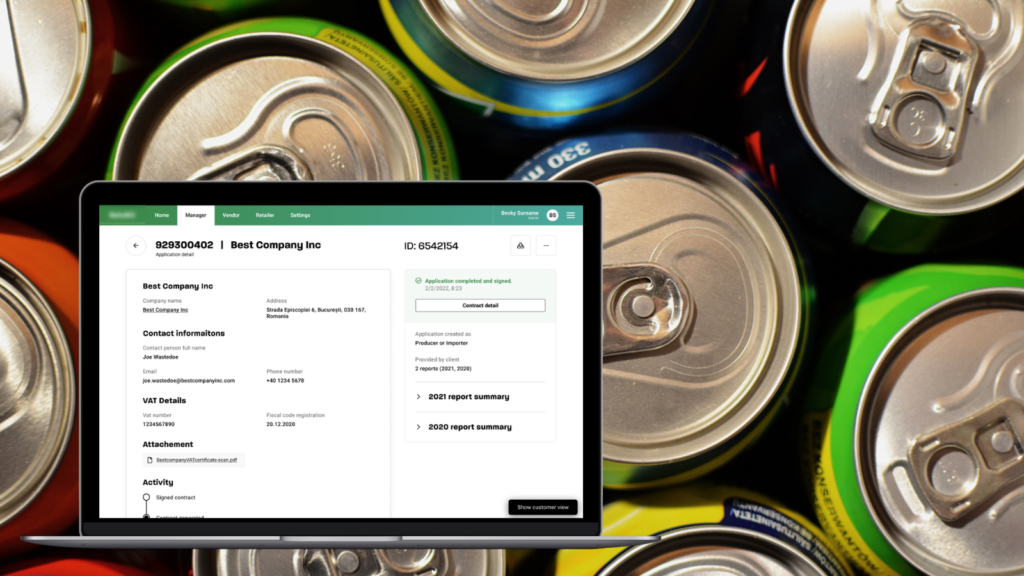

We talked to Peter Knaz who leads the Sensoneo’s DRS and take-back division about the importance of proper Registrations and Contracting preparation before launching the deposit return system. Sensoneo’s pre-DRS solution gives the operators a full overview of different entities on the market, what quantities of returned material they can expect, and last but not least allows for automated digital contracting.

Peter, in a few words, can you describe what pre-DRS is?

As the name suggests, the pre-DRS precedes the implementation of the deposit return system. It is essentially a market-mapping tool, but not only that. It includes reporting, when the operator receives detailed information about different entities and materials on the market, and contracting, which is digital and fully automated.

Can you tell us more about these two phases? Which of them comes first?

The order of the two is flexible, however most countries start with reporting.If the entities start with signing the contract, there is a risk they will not report data, or will report but not within the given deadline.

In the reporting phase, all the entities involved provide data on how many beverage containers they release on the market yearly. These data can be of different levels of detail: in case of producers it is possible to report the colors of the bottles, size and other variables, or only general information on how many PET/ glass bottles, cans or carton containers they release on the market every year. However in any case the operator comes to know how much material they need to process provided that the return rate is at 80-90 percent.

When talking about producers, the information reported is quite obvious. What kind of data do the retailers report?

The chain stores report information on the level of the whole chain, but also individual stores. It is especially crucial to know the sales of the biggest supermarkets, as they have an impact on the number of returned beverage containers in the area where they are located.

The data from retailers show where the biggest volume of returned packages is expected and the logistics can be planned accordingly: the operator knows where they need to have storehouses, sorting plans etc. When such data is used while logistics planning, the costs can be cut significantly: the closer the busy collection points are to logistics, the less expenses the operator has in the long-term perspective.

Another variable the retailers may report is what type of collection they plan to implement: whether an automated system like a reverse vending machine (RVM) or a manual scanner. If there are numerous retailers with manual systems, the operator knows they will need to introduce either public hubs with machines, or counting devices at interim storage facilities.

You already mentioned several entities, can we summarize what are all the entities that we need to take into account in the pre-DRS?

It depends on each country and its legal requirements. Some countries require all economic operators selling packaged beverages to participate, some exclude the hospitality (HORECA) industry or exclude smaller shops under a certain size. The entities involved may however include producers, importers and distributors, retailers including supermarkets and other shops, and hospitality industry: hotels, restaurants, etc.

How do operators ensure that the entities report all the information required?

The requirements must always be in line with legislation. Each country poses legally binding obligations on all involved parties which has to cover reporting, if we are to ask for such data.

Apart from that, the operator can promote reporting by cooperating with various associations or by targeted marketing campaigns.

And I suppose, the operator always wants to get as much relevant information as possible.

Indeed. The more relevant information the operator has and in more detail, the more efficiently they can plan the DRS. However, the data the entities provide are very sensitive, and naturally, some entities are hesitant to share. Therefore before the law is passed, there is always discussion among all the stakeholders, and an agreement must be reached.

One big issue that worries especially retailers is data protection. In Sensoneo we guarantee that all the data are stored in a secure environment and the access is controlled and very limited.

We know that the more security and comfort we provide to the operator, the better negotiation position they have when discussing data collection. Therefore we perfected the pre-DRS product so that it is easy to use for all parties and the entities report their data in safest environment possible.

To conclude the reporting phase, can we say what is the tangible result of the reporting?

The result of reporting and pre-DRS as such is essentially a map with all the collection points, each with its own specifics. When all the data is collected, the operator can use the data and export many types of graphs, charts, tables etc. in a business intelligence tool. They can create maps of regions, different tables with expected quantities in each region, and so on. It’s possible to work with these data even while the reports are still coming in. And when the reporting is done, the main aim is to use the data for strategically placing collection capacities, processing capacities and other infrastructure. The principle of pre-DRS is to build a data-driven deposit return system which saves financial and human resources.

Another very tangible result that will arise from reporting is, to put it very simply, the price of the DRS implementation. After the operator analyzes the data from reporting, they will know what kind of infrastructure they need to build and how much it will cost. And that is critical, since the difference in expected and real financial costs can be in millions of euro. When the system is not built properly, there may be further unexpected additional costs, which can climb very high in this type of infrastructure. Such a situation can be avoided by properly collecting and analyzing the data in pre-DRS.

Let’s take a look at the contracting phase now. What does it entail?

When the entities fill in all required information, they sign an automatically generated declaration that all the submitted information is true and correct. After this step, the system generates a standardized contract between the vendor and the operator. The vendor signs with a digital qualified signature, in remote locations it is possible to sign with a simple signature. Both are legally recognized. Once the contract is signed, that is the end of the pre-DRS process for the importers, producers, and retailers.

So the contracting process is obviously much faster than signing a contract manually.

Exactly, automated digital contracting is multiple times faster than manual collection of contracts. So contracting via pre-DRS can significantly accelerate the whole DRS implementation. It is up to the operator to determine a deadline for reporting and contracting, which is usually between one and three months. Collecting the manually signed contracts and reports takes at least half a year, and more time is necessary for processing and evaluating the data. This also includes a bigger team on the operator’s side who must retype and process the information.

Digital contracting saves time not only for the operator, but for the entities as well. When concluding the contract, the system automatically generates data from the registration form. The entity who signs the contract does not have to fill in any information, only check the information already provided, and sign the contract. The system provides maximum efficiency and the whole process is extremely fast.

So what happens after all entities sign the contracts?

Pre-DRS phase is done and the operator can proceed with the third phase, which is evaluation. Sensoneo is not involved in the stage as there are sensitive data, however if the operator needs a helping hand with some part of analysis of reported data under strict confidentiality, we are happy to provide a business intelligence package. Nevertheless the data itself and its analysis is in the hands of the operator.

To sum it up, what are the biggest benefits of pre-DRS?

The biggest benefit of pre-DRS is the data collected. Based on the collected data, which comes in structured, easy-to-use form, the operator can choose the best approach to capacity planning. And that is related to how much financial resources are needed to be invested in the system. Data from pre-DRS enable implementation of the most efficient and cost effective DRS system.

Automated contracting is another huge advantage. It can accelerate the process by a few months, that would otherwise be needed for manual contract signing and collection.

Among other valuable features of pre-DRS is the data protection, progress tracking and building IT systems. Pre-DRS IT system can be expanded and used when implementing DRS as such.

So it means that when an operator works with Sensoneo on pre-DRS phase, they should also use our DRS services?

We would of course be happy to cooperate on both, but it is not compulsory. We can provide pre-DRS solution also to operators, who use another DRS provider. All the data can be migrated to another IT system.

Is Sensoneo’s pre-DRS solution suitable for all operators?

Absolutely. The solution is scalable and flexible, which makes it suitable for any country. It can be used for countries with less than 3000 entities, but also more than 90 000. Each operator has its own specific requirements: whether all retailers are obliged to participate, what kind of beverage containers they plan to collect etc. Sensoneo is happy to provide a tailored solution to any operator.