In today’s dynamic business landscape, Environmental, Social, and Governance (ESG) factors are gaining prominence as critical metrics for assessing a company’s long-term sustainability and value creation. ESG reporting standards have become more than just a corporate responsibility; it’s now a strategic imperative. As businesses strive to align with European/global sustainability metrics and meet stakeholder expectations, understanding ESG reporting standards and ESG compliance is inevitable.

On 5 January 2023, the Corporate Sustainability Reporting Directive (CSRD) entered into force. It modernizes and strengthens the rules concerning the social and environmental information that companies have to report. A broader set of large companies, as well as listed SMEs, will now be required to report their sustainability metrics within the regulatory frameworks in ESG. Some non-EU companies will also have to report in case they generate over EUR 150 million on the EU market. Companies will have to apply the new rules for the first time in the 2024 financial year, for reports published in 2025.

Collection of ESG data will be mandatory for large companies starting January 2025, however, non-financial criteria will apply for smaller companies too. Large companies already require ESG data for reports from their suppliers.

ESG Reporting: for whom is it mandatory?

Large listed companies in the EU (listed with over 500 employees or more than €500 million in annual turnover) are required to produce an annual ESG report. Current requirements, however, are soon to be expanded. Only in the EU, this regulation will affect around 50,000 companies.

The CSRD will affect all EU-based companies who have:

- A net turnover of €40 million or more

- At least €20 million in assets

- 250+ employees

- All listed companies (except for micro-enterprises) will also be affected.

The CSRD, having a considerably larger reach than the NFRD (Non-Financial Reporting Directive), also impacts non-EU companies that have EU-based subsidiaries, or who have securities on EU-regulated markets. For example, UK or US-based multi-entity corporations with a single subsidiary in the EU will need to report in line with CSRD regulations, even if all their other subsidiaries are outside of the EU.

ESG Reporting: What must be reported under CSRD?

One of the major aims of the CSRD is to put the ESG reporting more coherently. The new CSRD reporting requires companies to report information concerning:

- The environment

- Treatment of staff and approach to social matters

- Human rights

- Anti-bribery and corruption

- Board diversity

Companies will be expected to provide all CSRD-related information in either their annual or management reports. This is to ensure that financial and ESG information is published at the same time and considered as a whole, rather than two separate reports.

How should companies report on sustainability information?

The CSRD introduced detailed requirements for sustainability information reporting across the EU, creating a common, standardized language for sustainability reporting.

ESG Reporting: European Sustainability Reporting Standards (ESRS)

The European Commission approved European Sustainability Reporting Standards, at the beginning of August 2023, which came into force on 01 January 2024. These Reporting standards are a set of rules, that the large majority of companies have to follow by preparing sustainability reports.

According to EFRAG’s proposal, there are 12 European Sustainability Reporting Standards (ESRS) that address a comprehensive spectrum of sustainability issues. The first set of ESRS contains two general cross-cutting standards and 10 topical standards, focusing on environmental, social, and governance topics (ESRS ESG). The new reporting standards enable a simple and logical structure of sustainability information.

Out of the 10 topical standards, 3 can be directly attributed to waste and waste management: ESRS E1 Climate, ESRS E2 Pollution, but mostly ESRS E5 Resource use and circular economy.

How can Sensoneo help?

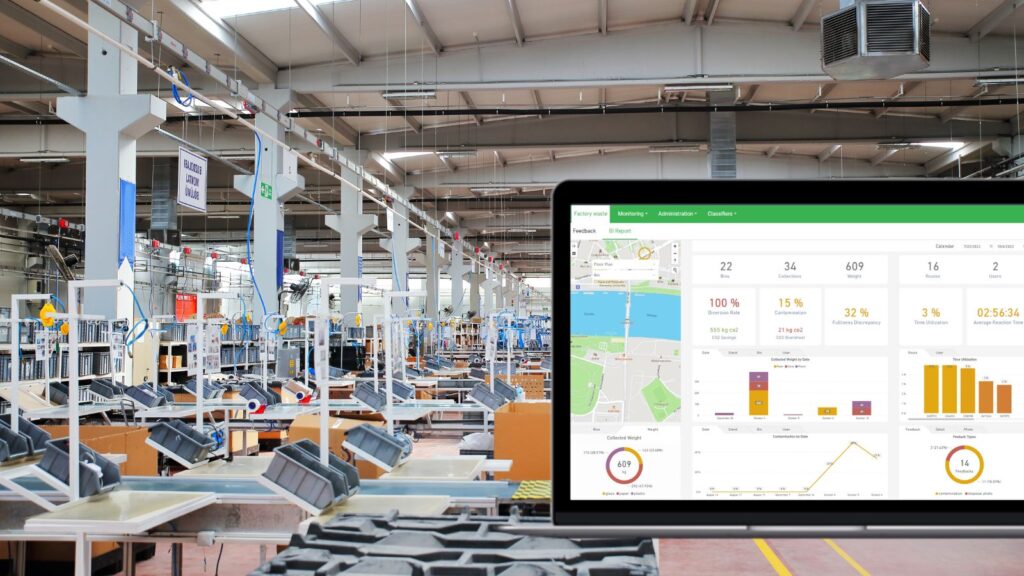

Sensoneo provides a holistic smart waste management solution ideal for enhancing ESG reporting in factories, facilities, and fulfillment centers. This system features intelligent sensors and user-friendly interfaces, including an innovative mobile app and a robust Waste Management System (WMS) software platform. By facilitating the continuous collection and analysis of waste data, Sensoneo enables companies to integrate detailed waste management metrics into their ESG reports. These metrics support compliance with ESG reporting standards and contribute to effective corporate governance.

Furthermore, our system enhances corporate sustainability by enabling data-driven decisions to optimize waste management strategies and improve sustainability KPIs like Waste Diversion Rate. This approach not only supports sustainable business practices but also aligns with corporate social responsibility goals. Through our comprehensive analytics dashboard and tailored email reporting, Sensoneo ensures that all necessary waste management information is readily available for regulatory frameworks in ESG, aiding in the transparent communication of green finance initiatives.